Real Estate Investment Trusts (REITs)

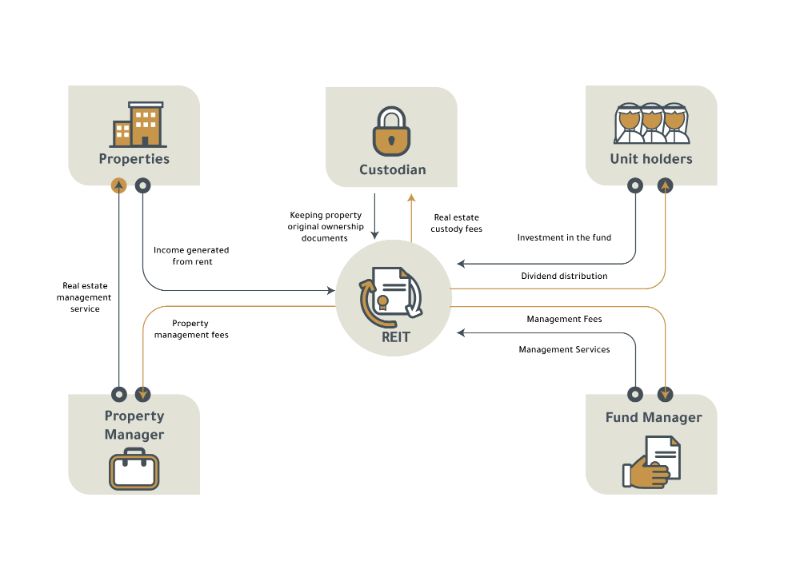

REIT is a traded fund that owns and operates income-generating real estate and real estate related assets. REITs pools the capital of numerous investors, which allows individual investors to earn a share of the income generated from real estate ownership, without having to buy or finance property or assets.

The income generated from the properties relies primarily on rent and profits are then distributed to unit holders on a quarterly, semi-annual or annual basis; depending the on real estate portfolio. In order to be categorized as REITs, 90% of the operational profits must be distributed among unit holders.

Boursa Kuwait’s Role is to provide to a transparent platform to trade REIT (traded) in compliance with Sharia and as per the Article of Association of each REIT.

Buying and selling REIT funds is done through licensed brokers registered with Boursa Kuwait.

Who is the target audience for REITs:

- Investors with small capitals willing to invest in real estate since REITs require a low entry cost

- Investors who are not interested in managing the property itself

- Investors interested in receiving periodical income from real estate investment

What makes a Real Estate Fund different than a REIT?

The difference between the two funds is structural as shown below:

| Boursa Kuwait REITs Structure | Real Estate Funds | |

|---|---|---|

| Asset Restrictions | REITs can only invest in developed Real Estate that generates income in Kuwait. (No Securities, Funds, Development Projects or Vacant lands) | The Fund may not invest more than 10% of its net asset value in Securities, The Fund may invest a maximum 15% of its net asset value in other real estate Funds No restriction on Securities, Funds, Development Projects, International Real Estate or Vacant lands) |

| Asset Concentration | The REITs investments may not exceed, directly or indirectly, 30% of the Fund’s net assets value upon contracting in a single real estate In order to qualify as a Single property REIT, the minimum property value has to exceed KD 30 Million. | The Fund investments may not exceed, directly or indirectly, 30% of the Fund’s net assets value upon contracting in a single real estate |

| Leverage Ratio | Maximum leverage ratio shall not exceed 50% of the fund’s assets. | Maximum leverage ratio shall not exceed 40% of the fund’s assets |

| Distribution Requirement | REITs are required to distribute at least 90% of the fund’s Net Profit at least once annually. REITs are allowed to distribute dividends on a Quarterly/Semi Annual/Annual basis. | No distribution requirement |

| Listing Criteria | Minimum number of unit holders: 225 with KD 5,000 lot or 450 with KD 2,500 or 900 with KD 1,250 lot with a Minimum float value: KD15 Million | Minimum number of unit holders: 225 with KD 5,000 lot or 450 with KD 2,500 Minimum float value: KD 15 Million |

| Fees | Trading fee: 10 bps Listing fee: KD 2000 Annual Subscription fee: KD 2000 | Trading fee: 10 bps Listing fee: KD 2000 Annual Subscription fee: KD 2000 |

Simple Breakdown of REITs: