Why List on Boursa Kuwait

Overview

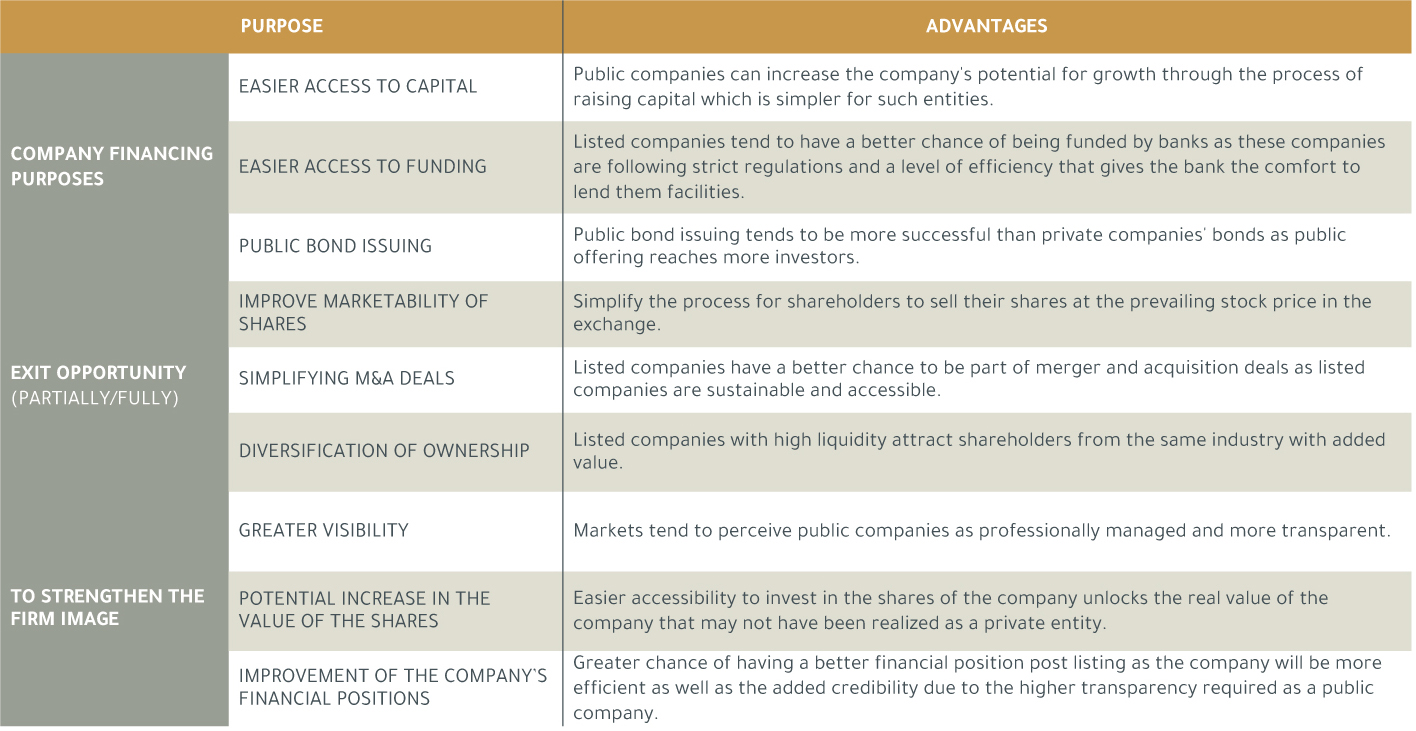

Going public at Boursa Kuwait can lead your company towards a route of progress and development. Listing can offer many advantages, such as increasing capital in various methods, gaining market exposure, and many other tools that help the company's journey to growth.

Companies can raise additional funds through the issuance of more stock or public bond issuance. Listed companies could use stocks instead of money in various methods, such as offering stocks in the acquisition of other companies, offer your employees stock options, thus making the company attractive to top talent.

Listed companies will also strengthen their credibility within the public and capital market stakeholders, which would increase the chances of obtaining loans from banks. Additionally, having a company listed at Boursa Kuwait could also attract the attention of mutual funds and institutional investors that diversify ownership and add value to the company.

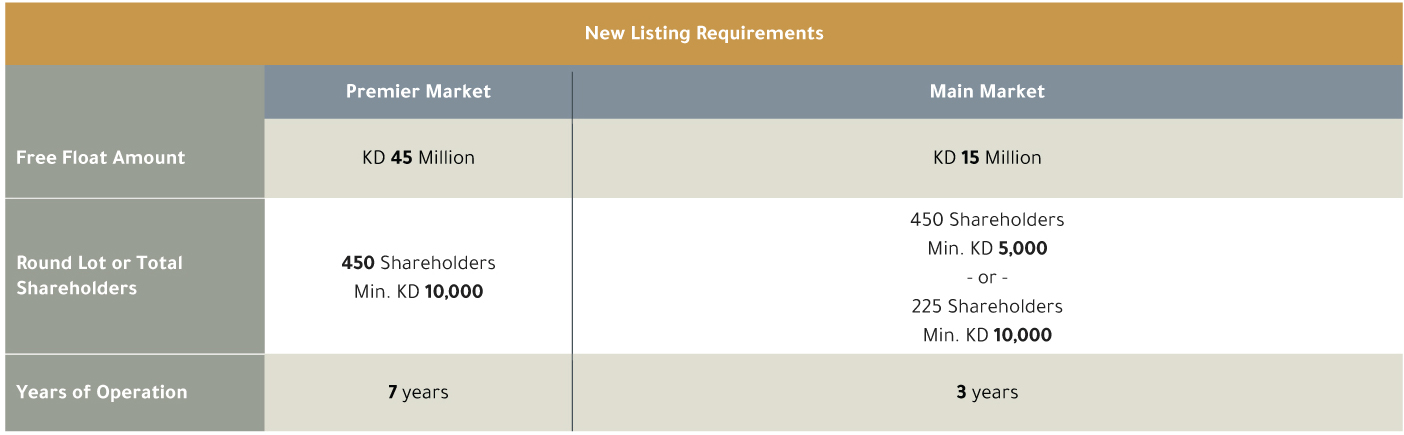

Listing at Boursa Kuwait has never been easier, as the listing requirements have been simplified and catered for different companies’ sizes to insure a smooth listing process.

For more information, you can contact us at

Benefits of Going Public

Foreign listing at Boursa Kuwait

- Straightforward and simplified listing requirements.

- Foreign companies can list at Boursa Kuwait without being listed in their origin country.

- Center for the financial services industry: Pioneers of the financial institutions in the region with a great track record.

- Wealth management: Historically Kuwait is known to successfully raise capital for growing companies. Boursa Kuwait is home to leading regional investment management firms, who are ready to raise capital for companies who are seeking capital growth and going public.

- Easy transfer of money in and out of country without capital restrictions.

A Trusted Regulatory Regime

Kuwait is globally recognized as a high-grade financial market. Furthermore, in 2010, Kuwait established the Capital Markets Authority, which is committed to setting supervisory and controlling regulations to support an attractive and competitive investment environment in the State of Kuwait, and based on the principles of fairness, transparency, and integrity according to international best practices.

- Recognized judicial system: Kuwait’s judicial system is recognized in the Gulf Region, while the establishment of the Capital Markets Authority has raised regulations up to international standards.

- Efficiently regulated marketplace: Boursa Kuwait’s “Premier” Market meets an international transparency level in terms of bilingual disclosures, an Investor Relations function, and analyst conferences.

- Listing rules that meet international standards: Boursa Kuwait’s listing rules are in line with the international standards, focusing on providing high liquidity through the required free float.

Listing Process

To assure a smooth listing experience. Boursa Kuwait has an assigned team to facilitate and support potential issuers in terms of ensuring their understanding of the listing requirements and answer any quires or concerns.

- Advisor Assignment: The issuer shall appoint a listing advisor to submit the application for listing and manage the process of listing.

- Application Submission: The advisor shall submit the listing application to Boursa Kuwait

- Evaluation and Recommendation: Boursa Kuwait will evaluate the application and issue its recommendation to the Capital Markets Authority (CMA) for final decision

- Revision by the Capital Markets Authority (CMA): CMA will review the application and the required documents for its final decision on the application.

Listing Requirements

Admission Requirements

Listing Fees

- Listing Application Fees

- Listing fees relative to Free Float

- Annual subscription Fees

Listing Products

Real Estate Investment Trusts (REITs)

A listed Real Estate Investment Trust (REIT) is a vehicle for investment in a portfolio of real estate assets, with a view to generating income for unitholders.

REITs’ assets are professionally managed, and revenues generated from assets (primarily rental income) are distributed to unitholders at regular intervals. Units of listed REITs are bought and sold like any other securities listed on exchanges at market-driven prices.

The majority of a REIT’s assets must be made up of real estate assets. This could include commercial, retail, industrial, hospitality, healthcare and residential properties that are located within a specified country or region.

Benefits to Property Owner

- Optimize capital allocation

- Monetize illiquid real estate assets

- Re-deploy proceeds towards value accretive investments

- Alternatively, distribute proceeds to unitholders

- Create an acquisition vehicle.

Valuation

- REITs allow for distributions in excess of accounting profits, maximizing valuations.

- Valuations are based on cash flows generated by the asset.

To find out more, kindly view the Real Estate Investment Trust (REIT) booklet.

Service For Listed Companies

Boursa Kuwait will partner you in your investor engagement efforts to support your capital markets needs and growth aspirations.

Investor Identification & Targeting

Shareholding Reports

- View trends underlying shareholding changes among top strategic shareholders.

- Gain insights on investor trends through analysis and market insights.

Investor Outreach

Corporate Day

- Meet a wide range of institutional investors in the span of 1-2 days

- Opportunity to profile your company to interested investors

- Network with peers

Analyst Conferences

- Engage a large number of active retail investors in one setting

- Opportunity to profile your company to interested investors

- Opportunity to increase awareness among retail investors

Research & Profiling

Equity Research

- Access a wide range of research firms to cater to your company’s sector and needs

- Independent research report to raise your company’s profile among targeted investors

- Credible research sources, that provides studies based on a market as a whole, sector performance, economic performance.