NMS and Circuit Breakers

Circuit Breakers:

- Index Circuit Breakers:

| Index Decline % | Halt Duration |

|---|---|

| - 5% | 15 minutes |

| - 7% | 30 minutes |

| - 10% | Market Close |

- Price Limits are set to:

Upper Limit: +10%

Lower Limit: -5%

- Security Circuit Breakers:

- Security Circuit Breakers are triggered at:

Upwards: +10%

Downwards: -5%

• Normal Market Size (NMS): NMS

Circuit breakers are regulatory measures to temporarily halt trading on an exchange, which are in place to curb panic-selling. They apply both to broad market indices such as the S&P 500 as well as to individual securities and function automatically, stopping trading when prices hit predefined levels, such as a 5%, 7%, and 10% decline in a market’s index. If a market index on Boursa Kuwait decreases by 5%, trading is stopped for 15 minutes, while a 7% decline prompts a trading halt of 30 minutes. Levels of 5% and 7% can be triggered once for each market in a trading day. If at any point during the day, an index falls by 10%, trading in that index’s market is halted, with no effect on other markets.

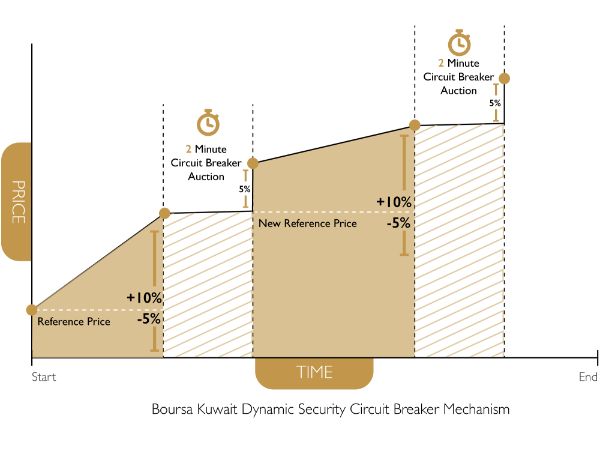

Circuit breakers are a form of market curbs. At Boursa Kuwait, security circuit breakers are triggered at lower limits of -5% and upper limits of +10%.

What happens when a market index falls by 5%?

If a market index falls by 5%, then trading on that market stops for 15 minutes, with no effect on other markets. For example, if the “Premier” Market index falls by 5%, trading in the “Premier” Market stops for 15 minutes, while trading in the “Main Market” goes on as usual.

What happens when a market index falls by 7%?

If a market index falls by 7%, then trading on that market stops for 30 minutes, with no effect on other markets. For example, if the “Main” Market index falls by 7%, trading in the “Main” Market stops for 30 minutes, while trading in the “Premier Market” goes on as usual.

What happens when a market index falls by 10%?

If a market index falls by 10%, then trading on that market stops for the remainder of the day, with no effect on other markets.

Are market indexes related? Does the halting on one market affect another?

No. Market indexes are not related. The stoppage of trading on one market does not affect trading on others. Only a decrease in a market index can halt trading on a particular market.

What is a security circuit breaker?

A security circuit breaker is a tool that halts trading on a particular security or stock. At Boursa Kuwait, security circuit breakers are triggered at a lower limit of -5% and an upper limit of 10%. Circuit breakers update the reference prices for the securities, i.e. an intraday dynamic reference price functionality is implemented. The lower and upper limits for the security circuit breakers are readjusted after each time a circuit breaker is hit. As soon as a circuit breaker is triggered in a security/stock, a two-minute auction takes place to cool off the market and to determine the new reference price.

Do circuit breakers apply to sector indices?

No. Sectorial indices are not affected by circuit breakers. Circuit breakers only apply to market indices (the “Premier” Market Index and the “Main” Market Index) and securities.