Trading Stocks

How to Trade Kuwaiti Capital Market Stocks

Stock trading refers to the buying and selling of shares in a particular company. If you own the stock, you theoretically own a piece of the company.

Trading in the Kuwaiti capital market is a simple process. To begin, you must have a trading account with one of the Capital Markets Authority’s licensed brokerage firms and approved by Boursa Kuwait. If you do not have a trading account, head to your broker and open one.

To open an individual account, you will need copies of your civil ID, a To Whom It May Concern letter from your bank with your account details and IBAN, a salary certificate or a certificate that verifies your source of income. Applicants under the age of 21 need a legal guardian to submit the application on their behalf.

Once you have opened an account, you have to deposit funds into your account to begin trading, which can be done directly through your broker or through the broker’s application. Through your broker, you can also view live market data, which is available on the Boursa Kuwait website with a fifteen-minute delay.

There are many tools that can guide you through the trading process. You can view the companies listed on the Kuwaiti capital market here, or you can see trades and stock prices through the MarketWatch page.

You can also download the Boursa Kuwait application on your iOS, Android, tablet or smartwatch.

Additionally, you can view Kuwaiti companies’ stocks on Yahoo! Finance or TradingView.

Trading Strategies

There are various methods used to accomplish an effective trading strategy, each with appropriate risks and rewards. Here are some of the most common trading strategies:

- Active trading is what an investor who places 10 or more trades per month does. Typically, they use a strategy that relies heavily on timing the market, trying to take advantage of short-term events to turn a profit in the coming weeks or months.

- Day trading is the strategy employed by investors who buy, sell and close their positions of the same stock in a single trading day, caring little about the inner workings of the underlying businesses, with the aim of making money quickly.

The Boursa Kuwait Trading System

All trading operations in listed securities shall be carried out through the Boursa Kuwait Trading System.

Orders are entered in accordance to the Market Model, and licensed brokers input buy and sell orders in the order received from the client, unless otherwise agreed. Before inputting orders, licensed brokers must ensure that the client meets the obligations of the Trading System as stipulated in the Boursa Kuwait Rulebook.

Required Information When Entering Orders in the Trading System

When entering orders in the system, the security name and security code, the type of order (in terms of price, quantity and duration), the price, whether to buy or sell, and the quantity as well as the Trader ID must be inputted by the user of the system (usually a broker).

There are several order types you can execute in the Boursa Kuwait Trading System, divided in terms of price characteristics into:

- Limit Orders, which are orders to buy or sell a number of securities at a specified price

- Market Orders, which are orders to buy or sell a number of securities without setting a price and relying on the current market price.

Orders can also be divided by volume:

- Fill and Kill (FaK), where any amount of the order that can be filled against any orders in the opposite side of the Orderbook, and any remaining quantity of the order is immediately cancelled

- Fill or Kill (FoK), whereby the order must execute immediately to its full quantity either in one trade or in multiple trades, or else it is cancelled.

They can also be divided by their duration:

- Day Orders, or when the buy or sell order that remains valid up to end of trading on the day in which the order is entered

- Session Orders, or when the buy or sell order remains valid until cancelled or up to the end of the session wherein the order is entered

- Good Till Cancelled, or when the buy or sell order remains valid until cancelled or executed, with the maximum validity of the order being 90 days

- Good Till Date, or when the buy or sell order remains valid until the end of the date specified during entry, for a maximum of 90 days

- Immediate Order, or when the buy or sell order is instantly executed for the largest possible quantity, with cancellation of the remaining or unexecuted quantity. The period of this order shall be during continuous daily trading only.

Another type of order is the Crossing Order, which is a single order entered through a single broker that includes a buy and a sell order for a security, whereby such orders are identical in quantity and price and are executed immediately. Crossing Orders may not be used for short selling and treasury shares, and adhere to the terms of Article 9.12 of the Boursa Kuwait Rulebook.

The Crossing Order is entered during continuous trading only and may not be entered during circuit break auctions. If there are outstanding buy and sell orders on the security, the price of the Crossing Order must be higher or equal to the best bid and lower or equal to the best ask, and if there are only sell orders, the price of the Crossing Order must be lower or equal to the best ask. Conversely, if there are only buy orders without sell orders, the price of the Crossing Order must be higher or equal to the best bid. Finally, if there are no outstanding buy and sell orders, the Crossing Order price is entered within the price limits of the security.

If a Crossing Order is entered at a price equal to best bid or best ask, the priority of the outstanding orders shall be maintained.

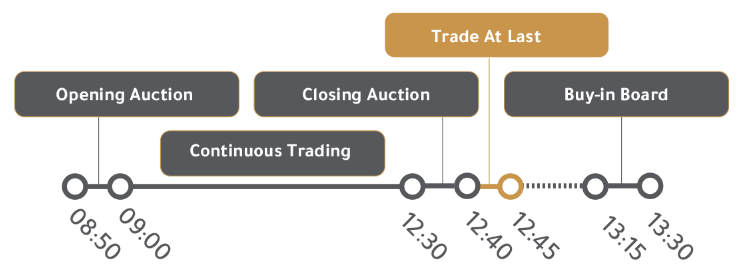

| SESSION NAME | FROM | TO |

|---|---|---|

| ENQUIRY | 07:00:01 AM | 08:50:00 AM |

| OPENING AUCTION | 08:50:00 AM | 09:00:00 AM |

| Order Acceptance | 08:50:00 AM | 08:59:00 AM |

| Pre Open | 08:59:00 AM | 09:00:00 AM |

| CONTINUOUS TRADING | 09:00:00 AM | 12:30:00 PM |

| Auction Market session 1 | 10:00:00 AM | 10:15:00 AM |

| Auction Market session 2 | 11:00:00 AM | 11:15:00 AM |

| CLOSING AUCTION | 12:30:00 PM | 12:40:00 PM |

| Close Auction phase one | 12:30:00 PM | 12:35:00 PM |

| Close Auction phase two | 12:35:00 PM | 12:40:00 PM |

| TRADE AT LAST | 12:40:00 PM | 12:45:00 PM |

| BUY IN BOARD | 01:15:00 PM | 01:30:00 PM |

| ENQUIRY | 01:30:00 PM | 02:00:00 PM |

| CLOSE OF DAY | 02:00:00 PM |

1. Trading Fees in Official Market

| Commission | Minimum Commission | |

|---|---|---|

| Premier Market | 10 bps (0.10%) | 250 fils |

| Main Market | 15 bps (0.15%) | 250 fils |

| Auction Market | 30 bps (0.30%) | 250 fils |

| Commission Split | ||

| Broker | 70% | |

| Boursa Kuwait | 29% | |

| Kuwait Clearing Company | 1% | |

2. Off-Market Trades (Negotiated Trades)

| Commission | |

|---|---|

| 20 bps (0.20%) | Commission |

| Off-Market Trade Commission Split | |

| 50% | Broker |

| 49% | Boursa Kuwait |

| 1% | Kuwait Clearing Company |

| Off-Market Application Fee | |

| KWD 50 | Buyer |

| KWD 50 | Seller |

3. Market Makers Rebate

| Percentage of Traded Value | 10%-15% | >15%-30% | >30% |

|---|---|---|---|

| Rebate | 30% | 60% | 90% |

| *Rebate dependent on percentage of monthly traded value | |||

4. Annual Subscription Fees

Annual subscription fees for all listed companies

| Closing Market Cap | % of Market Cap | Min | Max | ||

|---|---|---|---|---|---|

| From | To | ||||

| Category 1 | 0 | 25,999,999 | 0.1000% | 10,000 | 20,000 |

| Category 2 | 26,000,000 | 35,999,999 | 0.0850% | 20,000 | 30,000 |

| Category 3 | 36,000,000 | 69,999,999 | 0.0750% | 30,000 | 50,000 |

| Category 4 | 70,000,000 | 99,999,999 | 0.0650% | 50,000 | 70,000 |

| Category 5 | 100,000,000 | 149,999,999 | 0.0550% | 70,000 | 90,000 |

| Category 6 | 150,000,000 | 499,999,999 | 0.0450% | 90,000 | 110,000 |

| Category 7 | 500,000,000 | + | 0.0350% | 110,000 | 125,000 |

Late Fees

In the event of a delay in the allotted period for payment of the subscription fee, a 10% late fee will be levied on the company.

5. Funds & ETFs Listing & Trading Commission

| Listing and Annual Subscription Fee | KWD 2000 | |

|---|---|---|

| Trading Fee | 0.10% (10 bps) | Minimum Commission 250 fils |

6. Swap Transaction Fees

| Commission | |

|---|---|

| 20 bps (0.20%) | Commission |

| Commission Split | |

| 50% | Broker |

| 45% | Boursa Kuwait |

| 5% | KCC |

| Swap Application Fee | |

| KWD 50 | First Party |

| KWD 50 | Second Party |

7. Tender Offer (5%-30%) Fees

| Commission | |

|---|---|

| Seller | Regular Market Trading Commission(Premier, Main, Auction) |

| Buyer | Regular Market Trading Commission(Premier, Main, Auction) |

| Commission Split if Transaction is through broker | |

| Broker | 40% |

| Boursa Kuwait | 30% |

| KCC | 30% |

| Commission Split if Transaction is through KCC (Shareholder Registrar) | |

| Boursa Kuwait | 50% |

| KCC | 50% |

| Tender Offer Withdrawal Fee | |

| Buyer to Boursa Kuwait | KWD 1000 |

| Buyer to KCC | KWD 1000 |

Opening Auction

During the opening auctions first phase the Order Acceptance will take place where as orders can be entered but no matching occur. Orders cannot be cancelled and prices can only be improved. Right after this session a theoretical opening price is calculated and displayed.

Continuous Trading

During trading incoming orders are either immediately matched or take a place in the order book based on price/time priority.

Closing Auction

Within the first phase of the closing auction orders can be entered, amended or cancelled. However, the second phase of the closing auction only new orders can be entered, no order amendment or cancellation can be made. The end of the auction will occur at a random point in time during the last 2 minutes of this phase.

Trade at Last

Trade at Last is a trading session that takes place after the closing auction is concluded. The session lasts for 5 minutes only and the price at which the shares are traded cannot exceed or go below the closing price set.

Closing Price Mechanism

The closing price is usually set at the end of the closing auction when a security is traded in that session. If a security is not traded during the closing auction, the closing price will be equal to the last traded price.

If a security is not traded at all during the day, then the closing price will be equal to the reference price of the security.

Buy-in Session

A trading session dedicated to assist defaulting parties on delivery of shares to purchase those shares. Orders are matched at a single price at the end of this session.

| SESSION NAME | FROM | TO |

|---|---|---|

| ENQUIRY | 07:00:01 AM | 10:00:00 AM |

| OPENING AUCTION | 10:00:00 AM | 10:10:00 AM |

| Order Acceptance | 10:00:00 AM | 10:09:00 AM |

| Pre Open | 10:09:00 AM | 10:10:00 AM |

| CONTINUOUS TRADING | 10:10:00 AM | 01:05:00 PM |

| Auction Market session 1 | 11:00:00 AM | 11:15:00 AM |

| Auction Market session 2 | 12:00:00 PM | 12:15:00 PM |

| CLOSING AUCTION | 01:05:00 PM | 01:15:00 PM |

| Close Auction phase one | 01:05:00 PM | 01:10:00 PM |

| Close Auction phase two | 01:10:00 PM | 01:15:00 PM |

| TRADE AT LAST | 01:15:00 PM | 01:20:00 PM |

| BUY IN BOARD | 01:25:00 PM | 01:30:00 PM |

| ENQUIRY | 01:35:00 PM | 01:40:00 PM |

| CLOSE OF DAY | 01:40:00 PM |